Charitable Giving with an IRA: A Tax Savvy Strategy to Maximize Impact

The benefits of planned giving can be significant, and with the right strategy, can offer tax advantages. When considering the use of a taxable IRA for charitable giving, making Qualified Charitable Distributions (QCDs) can offer tax benefits while maximizing your giving.

One of the Center’s partners, Asset Preservation Strategies, has some great info for you to make the most impact with your charitable giving.

Schwab Charitable has outlined this approach, complete with a case study, that you may find useful:

- Give to charities (excluding donor-advised funds) during retirement years through a QCD.

Starting at age 73 the IRS mandates IRA owners to take annual income withdrawals, known as Required Minimum Distributions (RMDs). Failure to take these withdrawals could subject IRA owners to stiff penalties.

Retirement-age individuals and couples may not want to take an RMD for various reasons. They may have other sufficient sources of income for certain years. Also, the withdrawal, which is subject to ordinary income tax, may push them into a higher tax bracket, which can have adverse impacts on Social Security payments and Medicare benefits.

Thankfully, charitably-minded individuals and couples age 70½ and older have a tax-smart strategy called a qualified charitable distribution (QCD), also known as a charitable IRA rollover. The QCD allows a donor to instruct an IRA administrator to send up to $105,000 per year—all or part of the annual RMD—to one or more qualifying charities, excluding donor-advised funds. Couples who submit tax returns with married filing jointly status each qualify for annual QCDs of up to $105,000, for a potential total of $210,000. Donors can also direct a one-time $53,000 QCD to a charitable remainder trust or charitable gift annuity as part of recently passed SECURE Act 2.0 legislation. So with QCDs, more of your assets can be used to support your favorite charities that are making a difference.

The IRA assets go directly to charity, so donors don’t report QCDs as taxable income and don’t owe any taxes on the QCD, even if they do not itemize deductions. Some donors may also find that QCDs provide greater tax savings than cash donations for which charitable tax deductions are claimed. This is because adjusted gross income (AGI) is reduced, as shown in the case study below, and AGI is used in several key calculations, such as determining the taxable portion of Social Security benefits or what deductions and credits donors qualify for receiving.

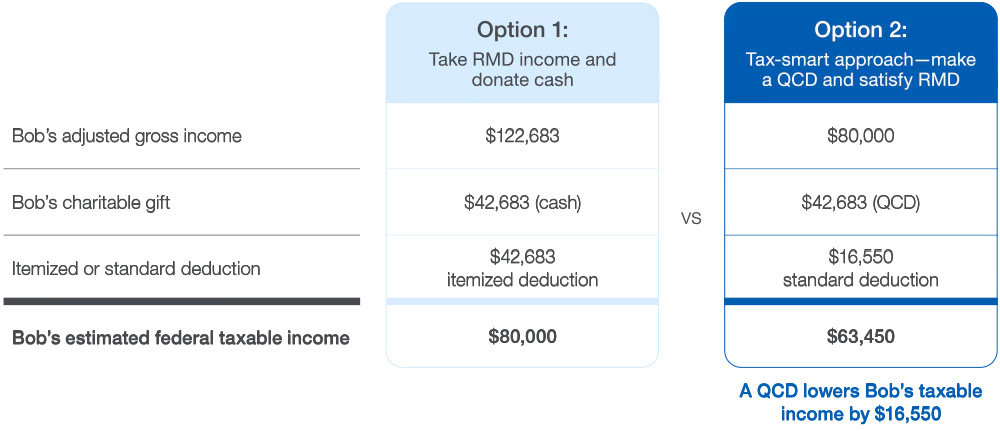

Case study: enhancing tax savings with a QCD gift

Bob is 75 years old in 2024 and needs to take a RMD from his traditional IRA. Bob’s traditional IRA is valued at $1,050,000, resulting in a projected RMD of $42,683. His ordinary income in 2024 is $80,000 and he will submit tax returns with the single filing status.

Option 1: Bob’s AGI is projected to be $80,000, but if he takes his RMD income of $42,683, it will increase his AGI to $122,683. If Bob then donates his RMD income to charity, he would take an itemized deduction of $42,683, assuming he has no other deductions to itemize. This results in $80,000 in federal taxable income.

Option 2: However, if Bob instructs his IRA administrator to direct his RMD as a QCD to an eligible charity, the RMD would be excluded from Bob’s taxable income. Bob then takes the standard deduction of $14,600 for 2024, plus an additional standard deduction of $1,950 because Bob is over 65 and has a single filing status. Therefore, his standard deduction totals $16,550. As a result, his federal taxable income is reduced to $63,450.”

While each individual scenario is unique and can vary greatly, I have seen how planned giving with a tailor-made strategy can benefit both the beneficiary and benefactor. As we approach the year’s end, if you are interested in learning how to maximize your planned giving strategy, I would be happy to speak with you.

Monica Szakos Cramer, CFP®, CEPA, BFA,

President & Senior Financial Adviser, Asset Preservation Strategies

monicas@asset-preservation.com

858.455.1825

Source:

https://www.schwabcharitable.org/giving-with-ira#:~:text=The%20IRA%20assets%20go%20directly,charitable%20tax%20deductions%20are%20claimed

Disclosures:

Asset Preservation Strategies (“APS”) is a dba of Axxcess Wealth Management, LLC a registered investment advisor with the SEC.

Monica Szakos, CA Insurance License #0I76089.

Advisory services offered through Axxcess Wealth Management, LLC an SEC Registered Investment Advisor. Axxcess, APS, or any of its IARs do not provide tax or legal advice. This material is not intended or written to provide and should not be relied upon or used as a substitute for tax or legal advice. Information contained herein does not consider an individual’s or entity’s specific circumstances or applicable governing law, which may vary from jurisdiction to jurisdiction and be subject to change. Clients are urged to consult their tax or legal advisor for related questions. .Advisory services are only offered to clients or prospective clients where Asset Preservation Strategies and its Investment Advisor Representatives are properly licensed or exempt from registration. The opinions expressed (i) do not constitute an offer of securities or a solicitation of an offer to buy securities, and (ii) may not be relied upon in making an investment decision related to any investment offering by Asset Preservation Strategies, LLC. Neither APS, nor Axxcess warrant the accuracy or completeness of the information contained herein. Opinions are current opinions and are subject to change without notice. Prices, quotes, rates are subject to change without notice. Generally, investments are NOT FDIC INSURED, NOT BANK GUARANTEED, and MAY LOSE VALUE.